Australia-based FP Markets is one of the most trustworthy and secure brokerage organizations in the industry of online trading. This well-known brokerage was created in 2005 and is headquartered in Sydney.

The Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC) are two of the most stringent FP regulatory authorities (Cyprus Securities and Exchange Commission.)

In addition, FP is well-known for its extensive selection of trading accessories (over 13,000), which includes forex, CFD, commodities, indices, and cryptocurrencies.

N.B.- FP Markets currently provides a 20% deposit bonus to traders worldwide despite being heavily regulated. Why are you still holding out for? Act fast if you want to benefit from FP Markets' 20% deposit reward.

FP Markets was named "Best Trade Execution" by the Ultimate Fintech Awards 2022, which were awarded at Columbia Beach in Limassol on the closing evening of the iFX EXPO International.

Craig Allison, president of Europe, the Middle East, and Africa, stated: "We are happy to be recognized as the market's leading fintech for trade execution. And winning this renowned award proves that our clients recognize our commitment to excellence, as does the industry.

The "Best Trade Execution" award is presented to the organization that consistently provides its clients with competitive pricing, timely execution, industry-leading technology, and exceptional customer service.

We at FP Markets are proud of these attributes and provide our clients with the greatest possible trading experience on a constant basis." An Ultimate Fintech Accolade is a renowned award given to fintech in the B2B and B2C online trade sectors.

Using their years of experience in the fintech and finance industries, Ultimate Fintech has produced a unique industry standard for brokers and B2B service providers, giving traders and businesses with a list of the top organizations with whom to trade and conduct business.

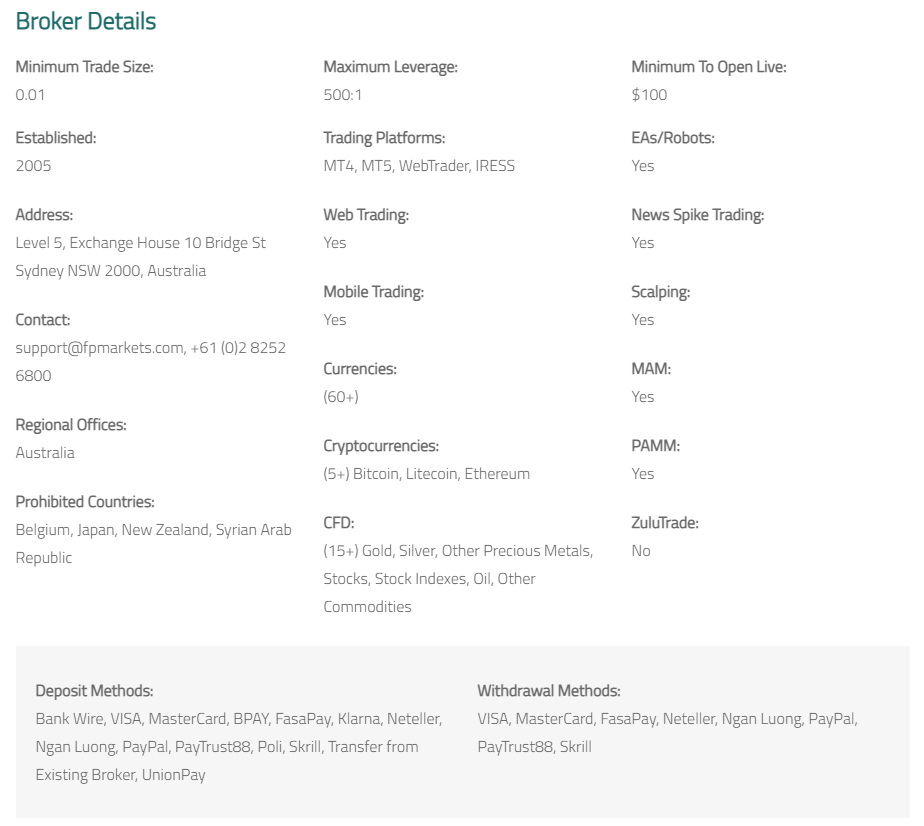

FP Markets provides traders with access to CFDs on Forex, Indices, Commodities, Stocks, Bonds, and Cryptocurrencies, one of the largest offerings in the business. Additionally, eight platforms are accessible, including MT4, MT5, and Iress.

Over the past 16 years, FP Markets has discovered that the most important factor in providing serious traders with the confidence to trade is a combination of continuously tight spreads and fast execution, cutting-edge platforms, a diverse product offering, and superior customer service.

FP is well-known for offering numerous trading accounts concurrently. To be more specific, FP's trading accounts fall into three distinct categories:

Therefore, choose wisely!

Within the trading platform, you can choose between Raw and ECN trading accounts.

The General or Raw trading accounts are best suited for beginning traders, with a $100 or comparable minimum commitment. In addition, the maximum leverage is 1:500, and according to commissions, it is available for basic accounts but not for raw trading accounts, which cost $3.

The IRESS accounts are then divided into platinum and premier trading accounts, which were designed for seasoned traders. In addition, the platinum account demands a deposit of $25,000 while the premier account requires a deposit of $50,000

FP is well-known for providing a multiplicity of separate trading accounts simultaneously. Specifically, FP offers three unique sorts of trading accounts:

Therefore, choose cautiously!

In the sections of the trading platform, you can choose between Raw and ECN trading accounts.

In the future, the General or Raw trading accounts are perfect for inexperienced traders, as the minimum deposit is only $100 or its equivalent. Moreover, the maximum leverage is 1:500, and costs are waived for standard accounts but cost $3 for Raw trading accounts.

The IRESS accounts are then subdivided into platinum and premier trading accounts, both of which were created with the needs of experienced traders in mind. In addition, the minimum deposit required for a platinum account is $25,000, but the minimum deposit required for a premier account is $50,000.

In addition, the minimum commission per transaction is ten dollars, and standard accounts incur an additional cost of 0.1%. Similar to gold accounts, platinum accounts require a minimum deposit of nine dollars and incur an extra cost of 0.09%. Margin requirements for CFDs and stocks begin at $3 for all three trading accounts.

Last but not least, we would like to emphasize that the spreads of FP are often quite modest and, depending on liquidity, can drop as low as 0.1 pips. FP Markets offers Islamic swap-free options in addition to MAM and PAMM accounts to Muslims throughout the world.

FP Market is almost certainly one of the most secure brokerage organizations operating on a global basis. First Prudential Markets, a prestigious Australian brokerage, is controlled by: The ASIC ( Australian Securities and Investments Commission ) The AFSL (Australian Financial Services License) number is 286354.

The CySEC (Cyprus Securities and Exchange Commission) issued license number 371/18 to the company. Hold your breath; more is forthcoming! FP is audited by BDO Australia, an external Australian independent auditor, and customer funds are also HEAVILY segregated by AAA-rated institutions.

Consider the Commonwealth Bank of Australia and the National Australia Bank.So, are you searching for the ideal broker to launch your online trading career? Get started with FP markets immediately.